- The Pulse by Augment

- Posts

- Wall Street wants Anthropic, and Washington wants equity

Wall Street wants Anthropic, and Washington wants equity

TL;DR. AI is getting bigger, louder, and more political. Anthropic is reportedly preparing for one of the largest tech IPOs ever in its race with OpenAI. Meanwhile, the U.S. government is quietly becoming a top startup shareholder, and Kalshi just became CNN’s official prediction-market data stream. Welcome to the future.

Anthropic reportedly preparing for one of the largest IPOs ever in race with OpenAI

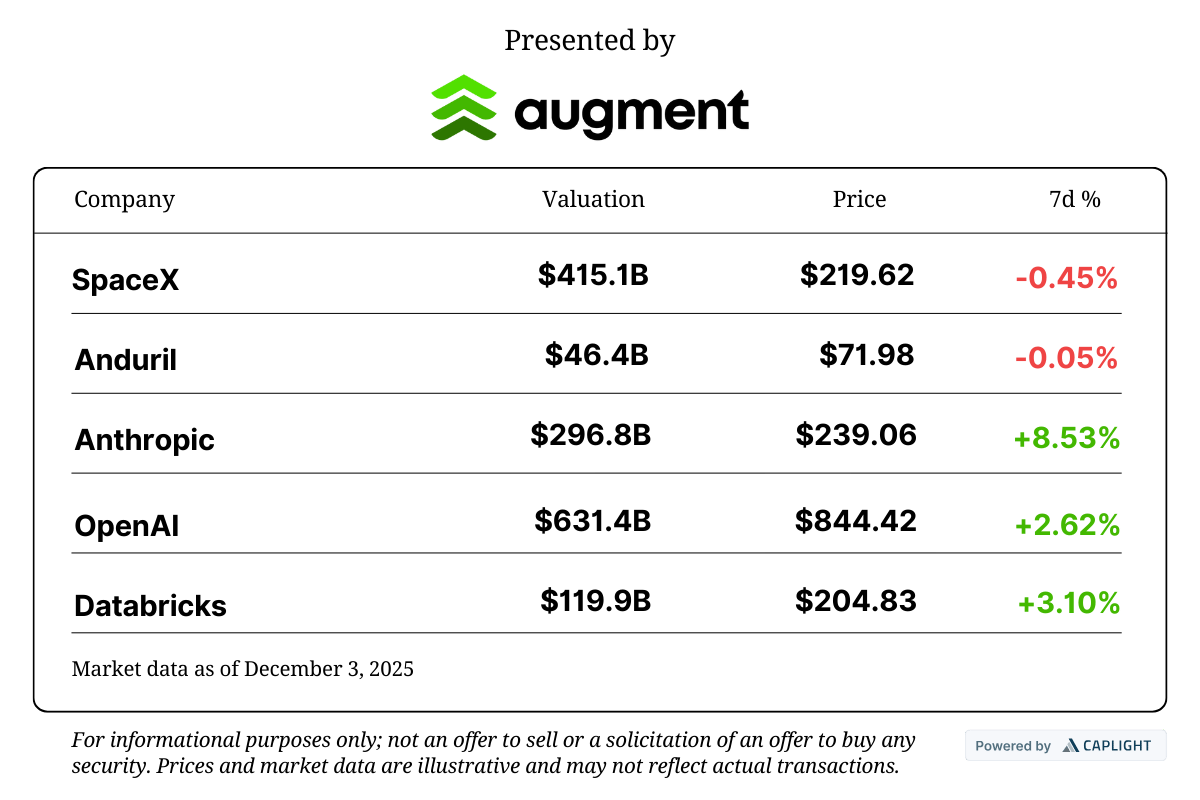

Anthropic is weighing a massive IPO while also considering major private financing from Microsoft and Nvidia that could value the company above $300B. The move positions Anthropic in a potential listing race with OpenAI and tests investor appetite for loss-making AI firms amid bubble concerns and steep infrastructure expansion.

What does it mean when Uncle Sam is one of your biggest shareholders? Chip startup xLight is about to find out

The U.S. government plans to invest up to $150M in xLight, potentially becoming the startup’s largest shareholder. The company is building particle-accelerator-powered lasers aimed at leapfrogging ASML’s chipmaking dominance. The move highlights Washington’s aggressive industrial policy and the anxiety in Silicon Valley as federal money reshapes competitive dynamics.

Kalshi raises $1B as CNN brings real-time betting probabilities to its broadcasts

Kalshi raised $1B at an $11B valuation and signed a deal to power CNN’s live political and economic probabilities, pushing prediction markets into mainstream news. Viewers will now see real-time odds on elections and major events on live broadcasts as Kalshi manages soaring volumes, rising scrutiny, and a national class-action lawsuit over its regulatory status.

ChatGPT just went from smart to intuitive.

In Sam Altman’s words, new ChatGPT “Pulse” feature is about making the chatbot your “super-competent personal assistant.” Every night, it reportedly scans your preferences, past chats, and connected data to generate a customized morning briefing. No prompts needed.

It’s proactive AI, and it’s quietly redefining user expectations.

Pulse won’t just wait for you to ask about flight deals or startup trends, it’ll tell you before you think to check. It bridges reactive behavior with predictive value, turning ChatGPT into a tool that anticipates rather than just responds.

This isn’t just a cool update. It’s the beginning of AI as ambient infrastructure.

Quick Takes

Pulse check. From headline-making raises to early bets with breakout potential, this week’s funding pulse check highlights where capital is flowing in the private markets. Whether you're tracking the next top pre-IPO name, mapping category momentum, or reading up on the hottest tech, these deals offer a snapshot of what’s heating up now.

More notable fundings this week

Brevo: Raised $583M at over a $1B valuation – Paris-based CRM platform Brevo aiming to challenge Salesforce and HubSpot globally.

Black Forest Labs: $300M Series B at a $3.25B valuation – German AI research lab developing foundational AI models. Backed by Salesforce Ventures, a16z, NVIDIA, among others.

Eon: $300M Series D at a $4B valuation – A cloud infrastructure startup enabling enterprise-scale AI data backups. The round was led by Gil Capital, with participation from Sequoia, Lightspeed, and others.

Antares: $96M Series B – A microreactor startup designing small nuclear power systems for use on land, at sea, and in space. Shine Capital led the round, joined by Alt Capital, Caffeinated, and others.

Cheerio! Until next week.

-Jack