- The Pulse by Augment

- Posts

- New year, new AI mega deals

New year, new AI mega deals

TL;DR. Nvidia just pulled off a $20B “non-acquisition” of Groq, bringing in elite talent and IP without triggering antitrust scrutiny. Meta scooped up profitable AI agent startup Manus for $2B, and OpenAI is reportedly going all in on audio-first devices as the race to replace screens begins.

Nvidia executes a $20B ‘non-acquisition’ masterclass with Groq

In a bold $20B move, Nvidia secured Groq’s IP and core team without technically acquiring the company. By structuring the deal as a non-exclusive licensing agreement, Nvidia avoided antitrust scrutiny. The goal is clear: dominate inference-class AI workloads by integrating Groq’s LPUs, known for ultra-low latency and deterministic execution.

Meta buys AI agent startup Manus for $2B

Meta acquired Singapore-based Manus in a $2B deal. The AI agent startup gained major attention after a viral demo and quickly reached $100M in ARR. With backing from Benchmark and Tencent, the company became one of the fastest-growing AI consumer apps. Meta will integrate Manus into its platform and cut Chinese ties post-acquisition.

OpenAI bets big on audio-first AI devices

OpenAI has restructured teams to focus on audio AI, with plans for a conversational, voice-first personal device expected in 2026. The company aims to create models that sound more human, handle interruptions, and feel like natural companions. With Jony Ive leading design, OpenAI is pushing toward a screenless future.

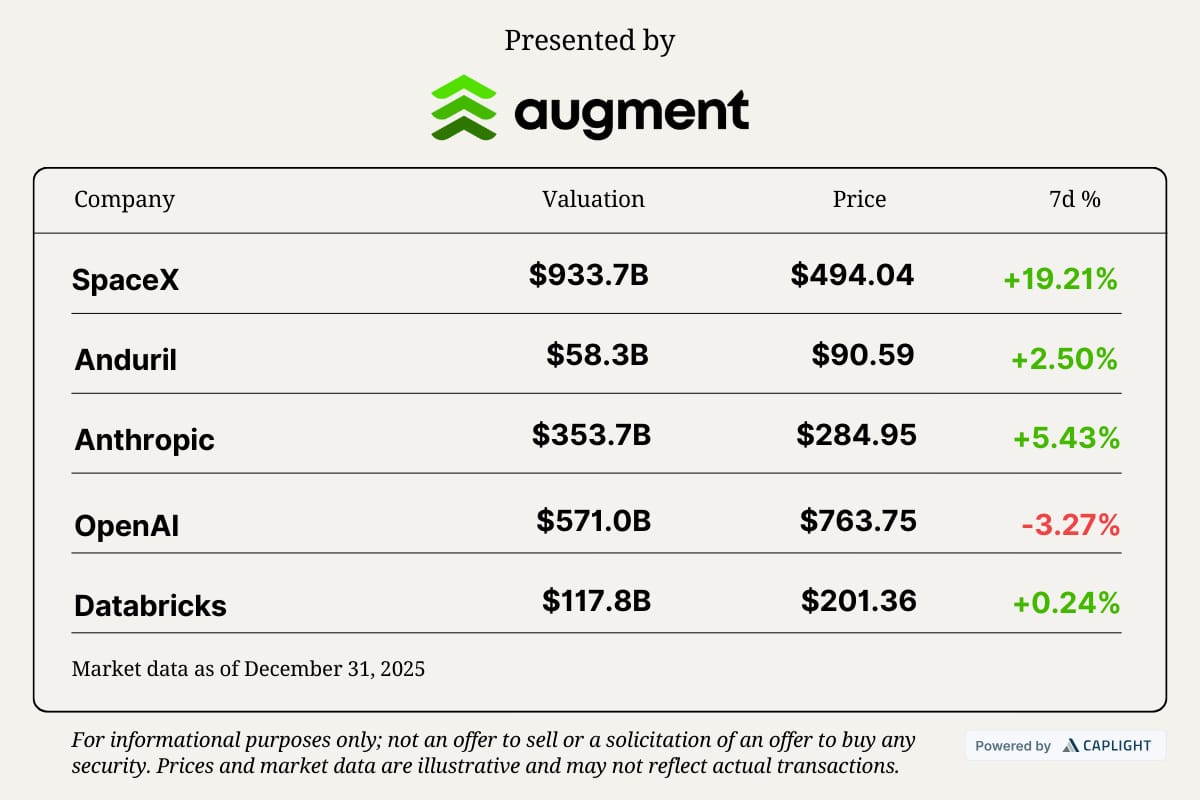

Google’s 2015 investment in SpaceX may go down as one of the best corporate bets ever

A $900M check at a $10B valuation could now be worth over $30B, and possibly more than $100B if SpaceX goes public at a $1.5T valuation. This was a bet on space infrastructure, not just rockets.

Quick Takes

Pulse check. Capital this week is flowing into frontier tech and applied AI, with investors backing startups that blend deep infrastructure with automation. From high-power satellites and enterprise workflows to industry-specific AI platforms, the focus is on scalability, defensibility, and real-world deployment. Here’s what’s catching investor attention:

More notable fundings this week

K2 Space: $250M Series C at $3B valuation – K2 Space, a California-based builder of high-power satellite platforms, raised $250M to accelerate delivery of spacecraft designed for the heavy-lift launch era. Backed by Redpoint, T. Rowe Price, Hedosophia, and Lightspeed, the company is scaling to meet $500M in signed government and commercial contracts.

Scribe: $75M Series C at $1.3B valuation – Scribe raised $75M in a Series C led by StepStone with participation from Tiger Global and others, valuing the workflow automation and AI documentation platform at about $1.3B. The company helps enterprises capture and optimize processes using AI, and its strong customer base drove investor confidence.

Nirvana Insurance: $100M Series D at $1.5B valuation – Nirvana Insurance secured a $100M Series D round that brings the commercial insurance platform for the trucking industry to unicorn status. The round underscores continued VC interest in AI‑enabled vertical SaaS addressing complex legacy markets.

Happy New Year from all of us at Augment!

Thank you for being part of the ride. 2026 is already shaping up to be a defining year for private markets, and we’re excited to keep building, tracking, and sharing it with you.

-Jack