Introducing: Thursday Thesis

Starting this week, Thursday editions of The Pulse will go deeper. While our Tuesday and Friday issues cover market news and weekly trends, Thursdays are for analysis—a single company, trend, or structural dynamic examined in detail.

We're kicking off with SpaceX, the most valuable private company in the world and potentially the largest IPO in history. Let's get into it.

Literally Astronomical

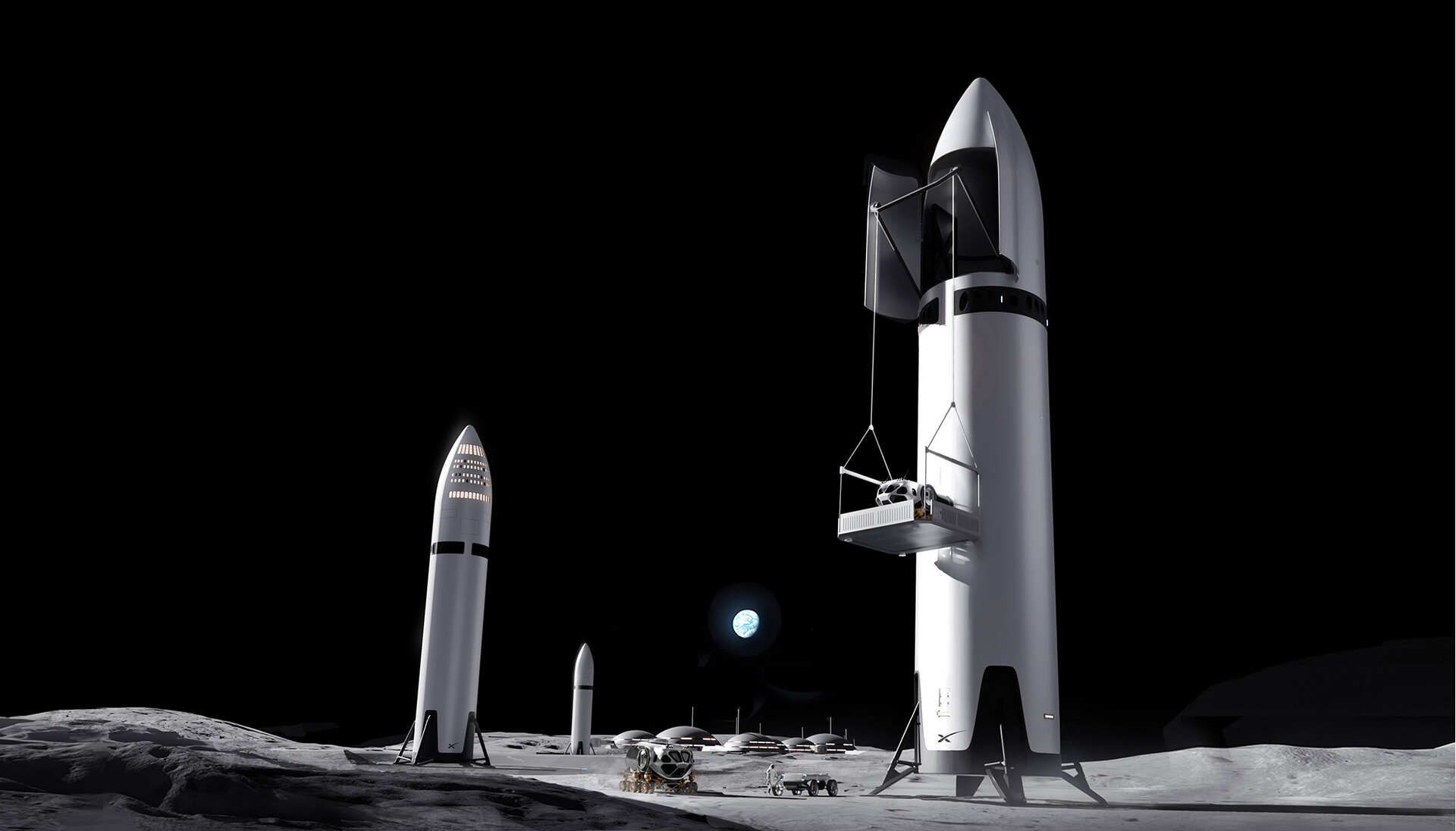

Moonbase, courtesy of Starship(s)

Elon Musk has confirmed SpaceX wants to go public soon. The valuation, according to Bloomberg, could be a staggering $1.5 trillion, raising $30 billion in fresh capital. That’s a 35% premium to its $988 billion private market valuation as today (according to Caplight data). The IPO would rival Saudi Aramco's 2019 $1.7 trillion listing / $29.4 billion raise as the largest IPO ever.

SpaceX's estimated 2025 revenue is roughly $15.5 billion according to various reports. A $1.5 trillion valuation would imply a 62-68x sales multiple. Meanwhile, Tesla, with six times the revenue, trades at around 16x.

What justifies that gap in the Elon-verse? The answer depends on which company you think you're valuing.

The Revenue Flip

The Falcon 9

SpaceX is synonymous with rockets. Falcon 9 launches dominate space news. Starship test flights captivate millions. The company's stated mission is making humanity multiplanetary, by landing on Mars, which is something Elon originally predicted he’d accomplish by 2021.

SpaceX’s massive Starship rocket and program are testament to the fact that while the dates keep shifting forward, the goalposts haven’t. But in the meantime, without a new planet to capitalize, er, colonize, the company’s revenue composition tells a different story.

According to estimates from Payload Space, Starlink generated approximately $8.2 billion in 2024—up 95% from $4.2 billion the prior year. That's roughly two-thirds of SpaceX's total revenue coming from satellite internet, not launch services.

The subscriber growth has been striking. Starlink reported 4.6 million customers at the end of 2024. By December 2025, the company announced over 9 million—nearly doubling in twelve months. According to Starlink's official announcement, the service now operates across 155 countries, territories, and markets. It’s also been great for PR. Elon regularly touts providing Starlink service to Ukraine, Iran, and other hotspots where conflict or censorship make traditional internet access difficult or impossible.

Rocket launches, meanwhile, contribute less than 30% of revenue according to these estimates. NASA contracts—once central to SpaceX's business—now represent less than 5% of projected 2026 revenue, according to Musk's December statements on X.

The math is clear: SpaceX makes most of its money selling internet service, not launching payloads.

The Vertical Integration Advantage

Man. Mountain. Starlink.

What makes Starlink unusual isn't just subscriber growth—it's how the service is built.

Traditional satellite operators buy launch services from third parties at market rates. Starlink launches on SpaceX's own Falcon 9 rockets, which have become remarkably efficient.

In 2025, SpaceX conducted 165 Falcon 9 missions—approximately one launch every 53 hours, according to Space.com. That represented roughly 85% of all U.S. orbital launches for the year. Individual boosters now fly 30+ missions each; booster B1067 completed its 32nd flight in December.

SpaceX put more than 3,000 Starlink satellites into orbit in 2025 alone. The constellation now exceeds 9,400 active satellites—roughly 65% of all active satellites currently in orbit.

This integration creates a structural cost position that competitors have not yet replicated. Amazon's Project Kuiper has announced ambitious plans but has not yet deployed commercial satellites. OneWeb, now part of Eutelsat, operates several hundred satellites but relies on third-party launches.

The Telecom Lens

If Starlink is the core business, telecom comparisons become relevant.

Traditional carriers trade at modest multiples. Verizon, with $134 billion in annual revenue, carries a market cap around $170 billion—barely above 1x sales. These are mature businesses with heavy infrastructure costs.

Satellite and cable ISPs have historically shown stronger margin profiles. Industry analyses have noted that established cable providers report operating margins of 20-40% on residential internet, with business segments sometimes higher.

Starlink's margins at scale remain to be demonstrated, though early data points are emerging. Financial statements filed with the Netherlands Chamber of Commerce showed Starlink's European operations posted $72 million in net profit on $2.7 billion in 2024 revenue—the service's first reported profitable year in that market. (Note: This represents European operations only, not global Starlink financials.)

The question for investors: Does Starlink's growth trajectory and cost structure justify a premium multiple, or do satellite internet economics converge toward traditional telecom over time?

The Next Bet: Direct to Cell

The iPhone turned 19 years old on January 9.

SpaceX isn't standing still on Starlink's current business.

In September 2025, SpaceX agreed to acquire spectrum licenses from EchoStar for approximately $17 billion ($8.5 billion in cash plus $8.5 billion in SpaceX stock), according to EchoStar's press release. A November follow-on added additional AWS-3 spectrum licenses, according to SpaceNews.

The spectrum enables "Direct to Cell"—satellite connectivity to standard smartphones without specialized hardware. According to SpaceX's FCC filings, the company plans next-generation satellites with significantly higher capacity than current Direct to Cell capabilities.

If executed, this positions Starlink to compete for mobile connectivity alongside—or potentially in partnership with—terrestrial carriers.

The capability is not yet deployed at scale. But the strategic direction is clear: SpaceX is building toward a future where Starlink serves not just rural broadband customers, but potentially any mobile user on the planet.

The Uncertainties

This was also a Falcon 9.

Several factors could affect the trajectory:

Valuation execution. The $1.5 trillion target requires public market investors to pay nearly double the current private market price. That premium is not guaranteed.

Competition. Amazon, China, and others are developing satellite constellations. First-mover advantages in technology tend to erode over time.

Regulatory complexity. Operating across 155 countries and territories means navigating numerous regulatory regimes. SpaceX has faced public disputes in markets including Brazil.

Capital intensity. Musk has stated IPO proceeds will fund Starship development and Mars ambitions—projects that require sustained investment without near-term commercial returns.

The Secondary Market View

SpaceX's December 2025 tender offer priced shares at $520, implying an $988 billion valuation. That's the most recent price established through actual transactions.

The gap between $988 billion and the $1.5 trillion IPO target reflects expectations about public market demand, continued execution, and the liquidity premium typically associated with listed shares.

Musk has previously floated taking Starlink public separately—which would let investors own the cash-generating ISP business without exposure to the capital-intensive exploration projects. No such filing has been announced.

The Bottom Line

SpaceX is both a rocket company and an ISP. The rockets enable the ISP. The ISP funds the rockets. The question is which business drives the valuation.

At $1.5 trillion, investors would be paying a significant premium for a company whose revenue is dominated by satellite internet—a business with strong growth but unproven margins at scale, facing emerging competition, and funding ambitious projects with uncertain timelines.

Whether that's reasonable depends on how much you believe Starlink's structural advantages persist, and how much optionality you assign to everything else SpaceX is building.

The rockets get the headlines. The internet service pays the bills.

That's our first Thursday Thesis. We'll be back Friday with the weekly roundup.

~Paul Smalera

See what's trading on the secondary market: augment.market

The Pulse is published by Augment, the marketplace for private company stock. Information provided is for educational purposes only and should not be construed as investment advice or a recommendation to buy or sell any security. Past performance is not indicative of future results. Augment Markets, Inc. is a technology company offering software and data services with securities-related services offered through its wholly-owned but separately managed subsidiary Augment Capital, LLC, Member of FINRA/ SIPC. Read our full disclosure statement here.